Written By: Sarah Bantz–CPA | Smith Patrick CPAs (with additional support from D.B. McCracken Law)

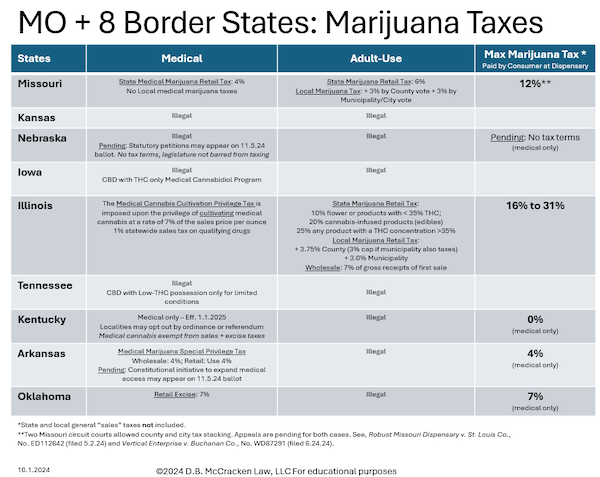

Missouri’s marijuana tax structure is giving cannabis operators and consumers something to smile about. Compared to Illinois, Missouri consumers enjoy significantly lower excise taxes—up to 22% less—on adult-use cannabis, making it an appealing market for both businesses and customers. But it's not just about lower taxes—Missouri’s approach to marijuana is setting a consumer-friendly standard with a broad range of product choices that's tough for neighboring states to match.

Looking to 2025, three bordering states may be changing the game. Kentucky is launching a medical-only cannabis program on January 1, 2025, with retail sales expected to be tax-free. As of October 1st, both Arkansas and Nebraska are litigating signature validity to make the November 2024 ballot. Nebraska’s initiative would create a statutory framework for medical marijuana while Arkansas looks to expand its existing constitutionally based medical program.

Marijuana Excise Compared to Sales Taxes

Article XIV of the Missouri Constitution enshrined the state marijuana tax, known as an excise tax. Excise taxes are usually levied on the privilege of using a particular good, like marijuana. Sales taxes are separate and generally applied to all final consumer retail sales.

Tax Stacking and Court Rulings

When Missouri legalized adult-use in 2022, local governments were given a path to add a 3% recreational tax. Local governments cannot tax medical sales. Recent court rulings in Missouri have upheld the legality of “tax stacking,” allowing counties and municipalities/cities to each impose a 3% excise tax on adult-use marijuana sales on top of the state-level adult-use marijuana tax. This means one dispensary may collect 6%, one 9%, and one 12% depending on local ordinance. Those court rulings are currently being challenged in the Missouri Eastern District and Western District court of appeals, respectively.

Dual Track Tax Payments for Retail Licensees

Retail licensees pay Missouri’s Adult Use marijuana tax on two distinct tracks. The 6% State Adult Use tax and the 4% State Medical tax are both paid online through the State’s official portal (Missouri Medical Tax Website). However, licensees need to manually navigate the system, as there’s no self-service reporting available to confirm filings or payments after the fact. Meanwhile, the County/Municipal tax is paid alongside sales tax using form 53-1, either on paper or through the MyTax portal. The County/Municipal adult use taxes are specific to recreational cannabis sales, so medical cannabis and non-cannabis accessories remain unaffected.

For those paying the county/municipal tax on form 53-1, expect to see two rates per location: higher rate for recreational cannabis, and a lower rate for all other sales, including medical cannabis sales. Keeping track of these distinctions is key to staying compliant without overpaying.

Penalties and Incentives in Tax Filing

An interesting quirk in Missouri’s system: neither ballot initiative included a concept of late payment or late filing of State Medical or Adult Use Marijuana Tax. The result is that there is no deadline, no interest, and no penalties for late payment or filing. Compare this with the County/Municipal Adult Use tax collected on 53-1, which includes a 2% credit for timely payment and filing, but also a 5% penalty for late filing and another 5% for late payment.

Impact on Missouri’s Cannabis Market

The State of Missouri aggregates sales data from online tax filings, and this data is a major indicator of the health of the state’s cannabis market. The proceeds from these taxes are put to good use, funding the Division of Cannabis Regulation, the expungement of criminal records, support for the Missouri Veteran’s Commission, and drug treatment services. It’s a cycle that supports both the industry and the broader community.

Sarah Bantz CPA

Smith Patrick CPAs

220 W Lockwood, Suite 203

Webster Groves, Missouri 63119

p: 314-961-1600

e: https://smithpatrickcpa.com/contact/