Since launching its adult-use cannabis market in 2023, Missouri has quickly established itself as one of the nation's most dynamic and innovative marketplaces, particularly in the pre-roll segment.

Let’s take a look at the unique regulations, market trends and key considerations for businesses looking to compete in this exciting and rapidly expanding pre-roll market place.

*All data was pulled from cannabis analytics firm Headset.io, which is sourced from consumer transactions in 13 states, including Missouri.

Market Overview

Missouri's pre-roll market has shown impressive growth since its inception in 2023. In the first half of 2024 alone, the state saw sales of more than 5 million pre-roll units, generating a healthy $73.9 million in revenue.

According to our friends at Headset, pre-rolls are the third most popular product category representing 15.4% of total sales. However, in comparison to the national market pre-rolls in Missouri are underrepresented capturing only 11.3% of total sales, the second lowest of Headset's tracked US markets. This suggests opportunity in the 'Show Me' state, where the emerging recreational market is still catching up to national trends.

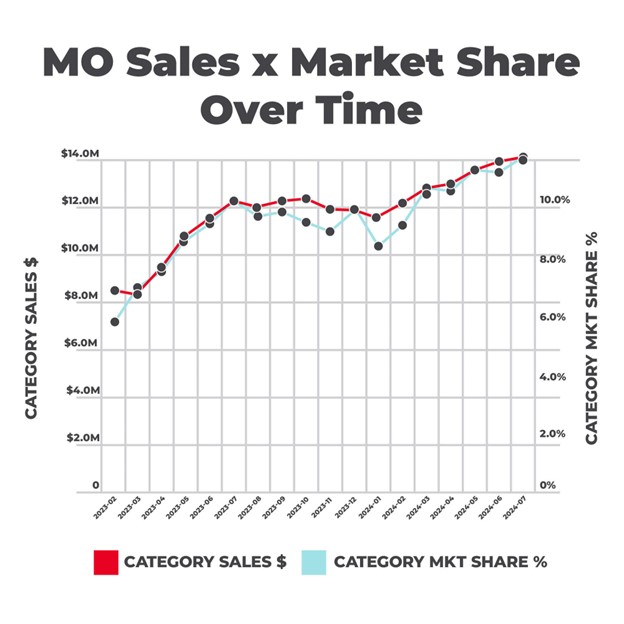

The market's trajectory has grown consistently though, with June 2024 recording $13.5 million in pre-roll sales, marking a 19.5% year-over-year increase from June 2023. This trend culminated in a record-breaking July 2024, when more than 1 million units were sold, bringing in more than $14 million in revenue.

The pre-roll category has steadily gained market share throughout 2024, reaching an all-time high of 11.4% in July. The pre-roll segement trails only flower and vapor pens, and holds the second position in unit sales.

Since the recreational market's launch, Missouri has seen nearly 13 million pre-roll units sold, generating an impressive $190 million in revenue through June 2024.

Product Trends

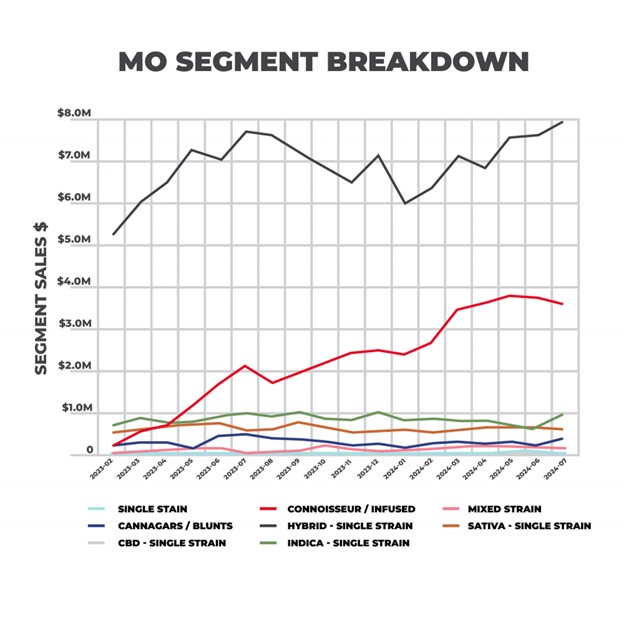

In terms of product popularity, Single Strain Hybrid pre-rolls currently lead the market. However, according to Headset, much of the categories growth is due to the rise in popularity of the 'Connoisseur / Infused' segment of pre-rolls, which is the most popular segment nationally capturing 45.8% of total pre-roll sales.

Again, this indicates growth potential within Missouri's red-hot infused market, particularly as producers refine their processes and increase harvest sizes, allowing for more flower to be converted into concentrates for use in infused pre-rolls.

The market has also seen a notable drop in average prices, with the cost per gram for pre-rolls dropping from $15.04 in July 2023 to $11.29 in July 2024. This price reduction has likely contributed to the increased accessibility and popularity of pre-roll products among consumers, as well as the continued development and innovation in the world of pre-roll machines that allow for lowered production costs for manufacturers.

Top Products and Brands

Another trend in the Missouri pre roll market, as in most markets, is the multi-pack, which combines several pre-rolls into a single package. Not only do multi-packs help producers cut down on packaging and labor costs, but also allows consumers to cut down on trips to the dispensary.

Looking again at Headset's market data, pre-roll multi-packs capture half of total category sales nationally and it is reflected in the Missouri data.

In fact, seven of the Top 10 pre roll products sold in 2024 to date are multi-packs.

Through the first half of 2024, the top selling pre roll products in Missouri were:

- Elevate Missouri – Grapefruit Durban Pre-Roll 10-Pack (5g)

- Vivid – Florida Kush Pre-Roll (.75 g)

- Illicit/Illicit Gardens – Smokos – Kansas City Kush Pre-Roll 5-Pack (2.5g)

- Illicit/Illicit Gardens – Smokos – Dawg Lemons Pre-Roll 5-Pack (2.5g)

- Elevate Missouri – Headband Cookies Pre-Roll 10-Pack (5g)

As for brands, Good Day Farms leads all others in sales with more than $24 million in revenue since the market opened, followed by CLOVR at $16.7 million and Illicit/Illicit Gardens at $16.3 million.

Regulatory Landscape

Missouri's regulatory framework for cannabis products, including pre-rolls, is among the strictest in the industry. The state mandates comprehensive testing for all products in their final form, screening for potential contaminants and while assessing quality indicators. This includes testing for moisture content, residual solvents, pesticides, microbial impurities, mycotoxins, foreign materials, heavy metals, cannabinoids, and terpenes.

These testing standrads protect consumers from potential health hazards. The truth is whether you're buying pre-rolls at a dispensary or packing your own at home, you should always be concerned about making sure your products are the cleanest on the market.

One unique aspect of Missouri's testing requirements is the inclusion of chromium in its heavy metals screening, in addition to the standard “big four” of arsenic, cadmium, lead, and mercury. This additional requirement reflects growing concerns about the potential health impacts of chromium exposure.

The state also imposes strict limits on microbials and mycotoxins, with particular attention paid to specific pathogens such as E. Coli, Salmonella, and certain Aspergillus species. These stringent standards aim to ensure product safety and quality for consumers.

And in the Show-Me State, all cannabis products are tested in their final form, including pre-rolls, which means that you need to be sure your pre-roll supplier tests their paper as strictly as you test your flower, or you may risk a failure.

Packaging and Labeling Requirements

Missouri's packaging and labeling regulations for cannabis products are designed to prioritize consumer safety and product transparency. All cannabis packaging, including pre-roll packaging, must be child-resistant, resealable, and opaque. The packaging material must also be FDA-approved for food contact.

Labeling requirements mandate that all marijuana products be clearly marked with the word “Marijuana” printed at least as large as any other text on the package. Additionally, packages must display a prominently featured universal symbol - a red and white diamond containing the letters THC and an “M.”

A unique aspect of Missouri's regulations pertains specifically to pre-rolls. While labels are not required on the rolling paper itself, the filter or crutch of a standard pre-roll cone can be considered the “method of administration.” As such, to ensure compliance, all Missouri pre-rolls should feature the required warning label on the filter.

Industry Insights and Future Outlook

As Missouri's cannabis market continues to mature, we see several trends emerging that could shape its future. The growing popularity of infused pre-rolls suggests that this segment may soon overtake single strain products as the market leader, as it has in other states as markets mature. This shift presents opportunities for manufacturers to establish their brands as innovators in this evolving space.

The state's strict testing and labeling requirements, while challenging, also create opportunities for product differentiation. Brands that can effectively navigate these regulations while meeting evolving consumer preferences are likely to find success in this competitive market.

Conclusion

Missouri's pre-roll market continues to show strong growth potential, with increasing consumer interest in innovative products and a regulatory framework that prioritizes product safety and quality.

As the market evolves, businesses that can adapt to changing consumer preferences while adhering to the state's rigorous standards will be in the best position to thrive.

+By Harrison Bard, CEO and Co-Founder, Custom Cones USA & DaySavers

Harrison Bard is the co-founder and CEO of Custom Cones USA and DaySavers. From custom branded and wholesale pre rolled cones to completely customized packaging projects and pre roll machines, Custom Cones USA helps companies bring their pre-roll projects to life. Harrison is an expert in all things related to pre rolls, from rolling paper science, to pre roll manufacturing best practices, to pre roll packaging laws and trends. Harrison has spoken at Benzinga, CannaCon, CWCB, and on multiple cannabis industry podcasts.