Register

Event Details

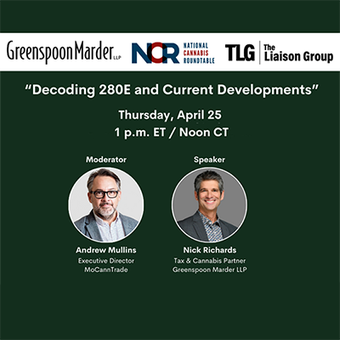

Decoding Federal 280E and Current Developments

Free Lunch and Learn Webinar

Thursday April 25, 2024 at 12:00pm

Please join us as our speakers discuss Section 280E and current positions that it does not apply to the cannabis industry and that it can be reduced under Section 471(c).

As seen in some of the national cannabis trade publications [mjbizdaily.com], multiple MSOs have filed amended returns for their medical cannabis business operations with the hope of 280E tax refunds. This webinar works to better understand those return/refund scenarios, Section 471(c), and how they might possibly apply to Missouri medical cannabis licensees if at all.

Introduction by MoCannTrade Executive Director – Andrew Mullins

Presented by Greenspoon Marder LLP Tax Attorney Nick Richards. Nick is an experienced tax attorney, partner, and co-chair of the Cannabis Law practice group at Greenspoon Marder LLP. As a tax controversy attorney, he represents individuals and businesses in tax audits & trials, M&A, and in managing tax debt. He also advises cannabis companies, owners and investors regarding tax and regulatory compliance matters. Mr. Richards has been a tax attorney for more than twenty years beginning his career with the IRS where he was a leading trial attorney, a Chief Counsel advisor, and a Special Assistant United States Attorney.

This webinar is brought to you as a collaboration between MoCannTrade, member org Greenspoon Marder LLP, Platinum member org The Liaison Group, and National Cannabis Roundtable.